KYC for Polkastarter IDOs

For a complete overview of the IDO process, see here.

How to do KYC - step-by-step

Note: if you passed a one-time KYC with Synaps for one of the previous sales, your status will automatically change to "Allowlisted" or "Allowlisted FCFS" and you can skip all of the steps below.

Go to your Polkastarter Dashboard to see if you have been selected for the project. If you are "Pre-selected" or "Pre-selected FCFS", you will be asked to start KYC soon. Check all possible statuses here.

- When your dashboard status changes from "Pre-selected" or "Pre-selected FCFS" to "KYC Open", click on the "KYC Open" status to start KYC. Alternatively, you can use the email sent from the project - please always verify the sender with our support on Telegram or Discord!

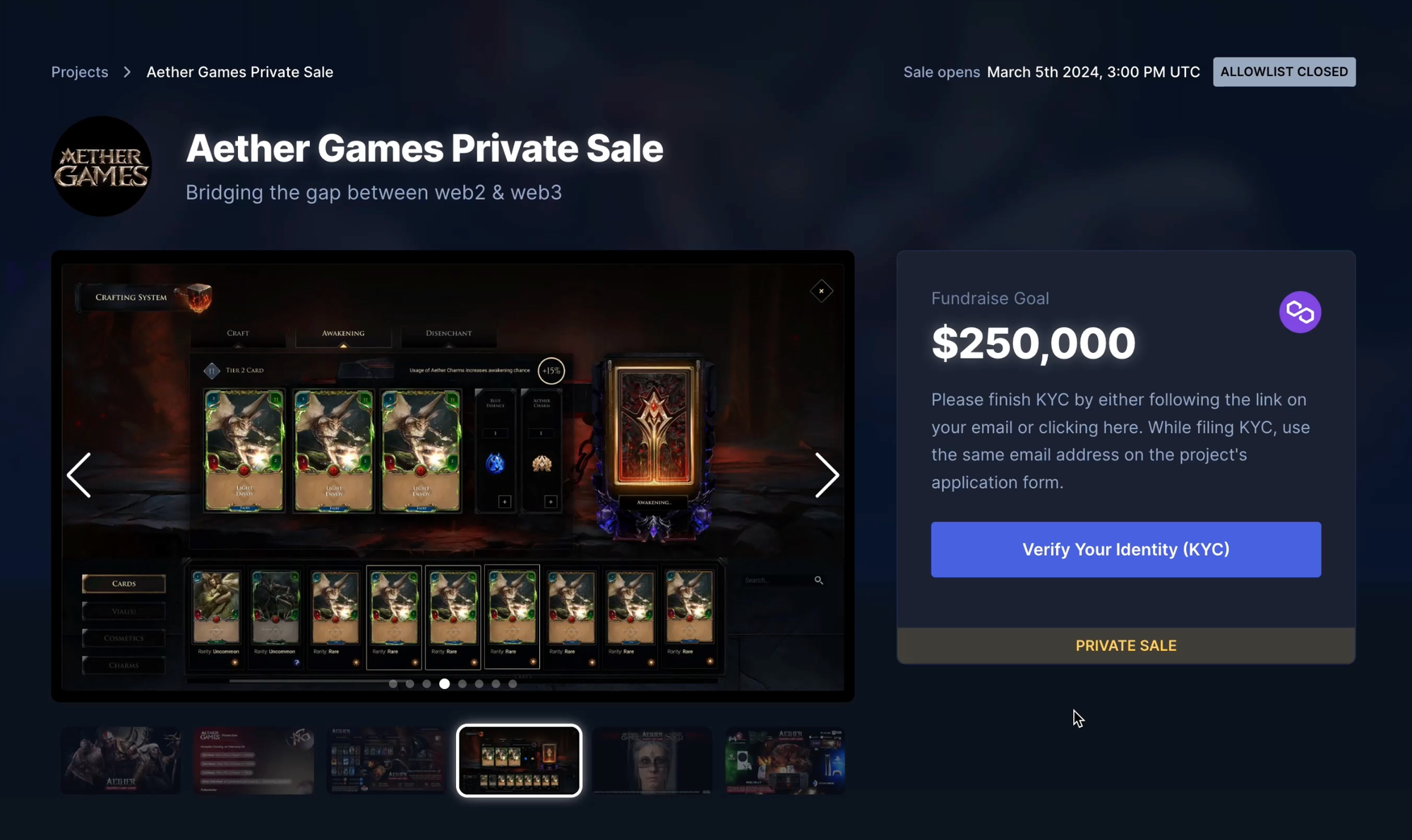

- On the Project Page, click the "Verify Your Identity (KYC)" button. This will trigger the KYC pop-up window to open.

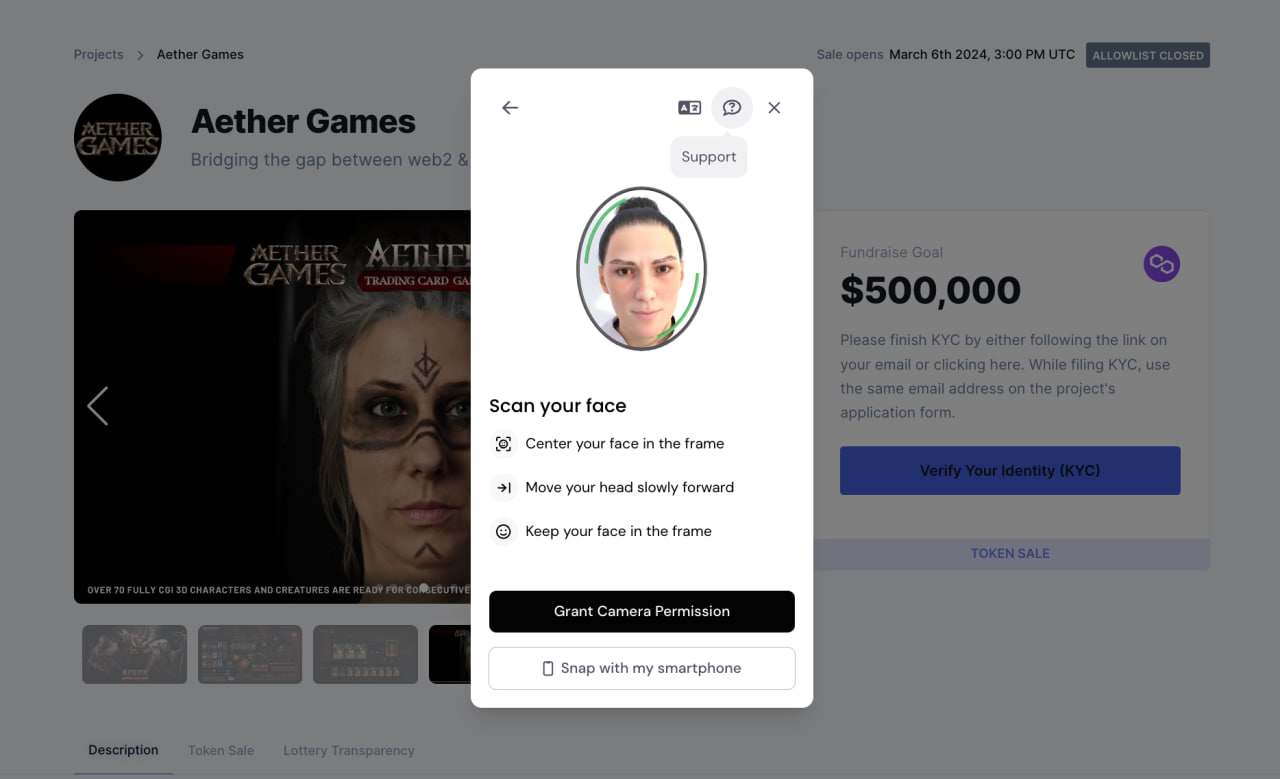

- Complete all of the verification steps, like document check, liveness check, and email verification. In case of problems, reach out to Synaps support using the "?" icon in the top right corner of the KYC window.

- Wait for the final approval from Synaps. In case you are approved, that's it!

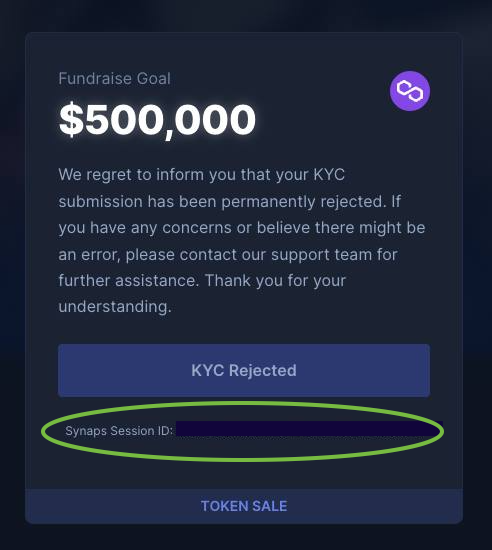

- If you got rejected, reach out to Synaps support to know the reason. You can access your KYC session using your "Session ID" displayed on the Project Page. Copy this character sequence and paste it into the following link in place of the YOUR_SESSION_ID placeholder: https://verify.synaps.io/?session_id=YOUR_SESSION_ID - this should re-open the KYC pop-up window, where you can click on "?" icon to contact Synaps.

In case of any complications or further questions, you are always welcome to contact our support team on Telegram or Discord.

Overview

At Polkastarter, you need to do KYC if you are selected for the project allowlist, not in advance.

Who's in charge of KYC?

Projects that launch with us are in charge of their respective KYC. Requirements may be different for different projects.

How to start the KYC process?

After you are preselected in the lottery, you will be notified by email from the project about the KYC process opening. Alternatively, you can start KYC right from your Polkastarter Dashboard, when your project status shows "KYC Open" - simply click on the status button to get redirected.

What goes into the KYC?

In simple terms this is how KYC works:

1️⃣ User clicks on an authorization link to KYC.

2️⃣ User goes through the KYC journey which includes liveness checks, face matching & ID doc verification.

It's worth noting, that if you already KYC'ed with Synaps before, your verification status is already saved and you don't have to repeat KYC again.

Requirements and country restrictions

Requirements may be different for different projects and depend on the project's individual situation, like their country of registration. However, it's always worth familiarizing yourself with your own country's policy towards IDO participation to know if you are possibly eligible to take part in the sales. In case of ambiguities, it's advisable to consult a lawyer.

Why to KYC?

If you’ve participated in many past Polkastarter IDOs, you may be asking yourself:

Why do different projects have varying approaches to their KYC processes?

If you haven’t yet participated in an IDO, you may be asking:

Why do I need to complete KYC at all?

For early-stage projects, remaining compliant throughout their product development — and especially during a token launch — is paramount. KYC is a standard practice among financial organizations offering/distributing any sort of service or asset. Going through a KYC process ensures every IDO participant has been vetted and found ‘fit’ for participation.

The process is also important in ensuring compliance with legal requirements surrounding fundraising not only on the blockchain but in the wider ‘real’ world. Traditional investing and betting platforms typically include KYC in their own compliance procedures to guarantee the legality of their operations

‘Due to the borderless nature of blockchain and crypto assets in general, determining which countries to allow participation in our IDO proved to be somewhat of a legal quagmire. We consulted a specialist legal firm who, due to regulations not being clear for many countries and their propensity to caution, provided us with an extensive exclusion list.

We analysed the exclusion lists for many projects operating within the same jurisdiction as ourselves and, following consultation with some of our investors, several VCs and incubators, we reviewed the list with the legal team and settled on a slightly less restrictive country list.

Every user that participated in our IDO was individually vetted and underwent a KYC process before being allowlisted to participate.’ - PolkaLokr

Polkastarter is a platform that enables secure, efficient, and user-friendly access to some of the highest-opportunity IDOs in the ecosystem. We partner with these projects to support them in their token launch, advise them in their community growth, and introduce them to our own incredible community of blockchain enthusiasts.

Polkastarter does not, however, have any direct control or mandate over a project’s KYC requirements or process. Based on where projects are located, the composition of their organization, the design of the token, and more, each project will have different reasons for requiring KYC to ensure regulatory compliance. Projects may choose to restrict participants from certain countries because of a region’s crypto laws or status as a region at high-risk of fraud. Here is another example of a previous IDO project's approach to KYC.

‘Fractal ID is a conversion optimised identity verification provider specialised in the crypto and DeFi environment. Throughout all the IDO projects that they have supported, their laser-focus on user conversion ensures a comfortable user journey and high compliance.

In simple terms this is how it works:

First, the user clicks on an authorization link to KYC.

Then the user gets processed through the KYC journey which includes liveness checks, face matching and ID doc verification.

Afterward, a team of specialised operators will verify the documents in any given language. If there are no additional documents required, the user gets an approval email as well as the status of a verified user.’ - Fractal Protocol

--

Polkastarter maintains no control over this KYC process, and cannot require that KYC’d individuals from one IDO be automatically KYC’d for future IDOs — as each project retains the right for different, nuanced, and specialized KYC requirements.

Again, we want to stress out that an inability to participate in a given IDO due to specific country restrictions is outside our control. Polkastarter is not in a position to 'allowlist' countries for IDOs.

For more information about the allowlisting and KYC process, you can also see here.